Take Your Credit Score To Your Desired Level

Honest, Fast Credit repair with the help of a 1 on 1 credit professional makes a difference!

We Deliver Fast Credit Repair Results While Using Fair Credit Reporting Act Credit Dispute Letters and legal strategies to raise your credit score.

Who We Are

One of our goals at Platinum Credit Resources is to see our clients live the life of their dreams by helping them achieve their financial goals and by increasing their credit score with our proven strategies. We treat every customer’s profile with respect, because we understand that things do happen! We are more than just a onetime credit repair agency! We train our clients in financial literacy and to develop the mindset of financial success. We understand the pros and cons of credit and we break them down for you in clear human terms, to help you succeed in your financial goals. If we don’t have an answer to your question, we don’t stop doing research until we find an answer.

It doesn’t matter if you’re trying to buy a car, house, start a business, get a job, or get insurance, your credit will be checked! It’s our mission to ensure that your credit matches your goals, so you can build wealth and live the life that you deserve!

Our pride is high

Here at Platinum Credit Resources, we pride ourselves on being one of the leading credit repair and counseling company that serves a large array of clients, all with both common and un-common issues and errors. Outside of finding and disputing errors on your credit report we can also assist you with negotiating better terms on collection accounts that you do have to pay.

Why Use Platinum Credit Resource

- Late Payments

- Collections

- Inquiries

- Repossessions

- Charge offs

- Evictions

- Bankruptcies

- Judgements

- medical

- and more

What We DO

Comprehensive Credit Assessment

Upon signing up with Platinum Credit Resources, one of our Certified Credit Improvement specialists will assess your credit report and provide a through credit analysis. Please feel free to point out any inaccuracies that you are aware of. We will then provide you with a FREE individualized plan to assist with re-building your credit, you will also be advised on the best realistic method to assist with achieving your credit goals.

Credit Counseling

Once you credit report is assessed, you will be able to log into the secure online portal to upload the information received for the credit bureaus as well as communicate with your designated credit repair specialist. We will take our time to challenge each error and discrepancy. At Platinum Credit Resources we will guide you through the process to ensure that you choose the best method to assist with financial freedom. You are informed at very stage in the credit repair process.

Credit Repair Disputing

We contact creditors & credit bureaus on your behalf, sending documentation and requesting proof and evidence of the debt incurred. In certain cases, we even contact the original creditor to get the situation rectified. Next, we monitor the scores obtained from the credit bureaus to ensure only accurate and up-to-date information is reflected and nothing has been changed without a reason. Throughout the process, we note all changes and explain them to you in detail.

Credit Building

We inform you on a suggested amount to pay on certain bills in order to raise your credit score. We refer you to various companies to obtain credit that assist with bring your score up. We also give you pointers and suggestions on ways to raise your credit score.

Get all 3 Reports and Scores Now!

New 3-Bureau Report included monthly.

Platinum Credit Resources requires ALL clients to maintain active credit monitoring. This allows us to pull your credit report and track your progress during your credit repair journey (deletions, score changes, new accounts, etc). Any clients that cancel and/or downgrade their credit monitoring service will be suspended from the program. Click on the buttons below to signup.

Why Credit Repair and Counseling

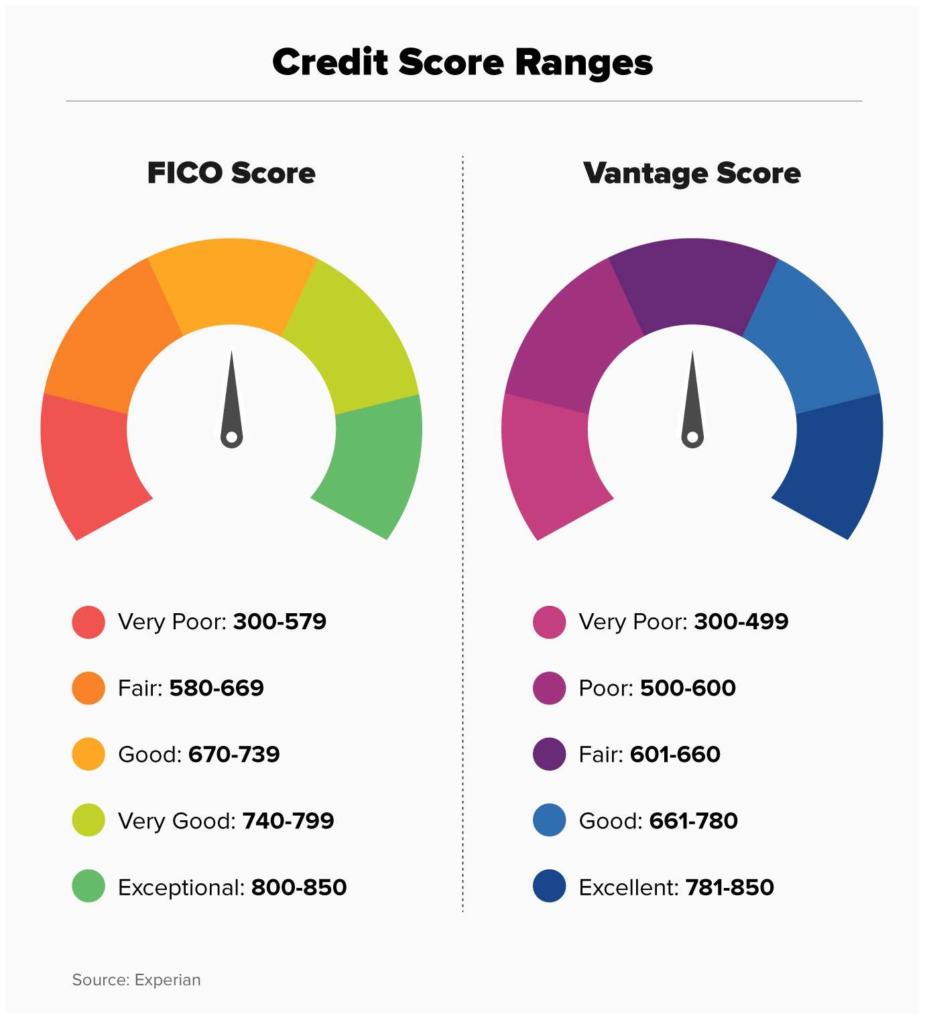

Your credit score comes from your credit report; it is your spending and repayment report card. Believe it or not…The credit bureaus give grades from A-F for certain credit categories. A being Great and F being Horrible! Unfortunately, in a lot of instances, Credit reports often are NOT correct, and incorrect information can hurt your score. We work as hard as we can to ensure your credit report contains correct information which in return will provide you with the highest score possible for your credit situation.

Negative Factors= Collections, Charge-offs, Repos, Loans, Delinquent accounts, Closed accounts, medical bills, Judgements and Late Payments.

Positive Factors= Long and Positive Credit History, Low Credit Utilization, Positive Trade Lines, On-Time Payments and Paying More Than the Monthly Minimum on Payments.

Your payment history is one of the most important credit scoring factors. Having a long history of paying different types of accounts on time can help you build excellent credit, while missing payments or not paying on time can hurt your credit score and cost you a ton of money in the long run.